Understanding Why Personal Budgets Often Miss the Mark

Written on

Chapter 1: The Reality of Household Budgeting

When it comes to managing finances, many people find themselves struggling despite their best efforts. While I lack formal training in finance and do not claim to be an expert financial planner, I have spent countless hours analyzing not only my own household budget but also those of family members who depend on me. I am meticulous about financial accountability. However, my budgeting endeavors frequently fall victim to unexpected events. This is where many financial experts, including respected figures like Dave Ramsey, often overlook the realities faced by everyday individuals.

Section 1.1: Understanding Debt

It's no secret that many individuals fall into significant debt due to desires and needs. While some debt arises from excessive spending, much of it results from the average cost of living and urgent household issues. Here are several genuine factors contributing to the debt crisis:

- Unexpected medical bills and co-pays

- Rising insurance premiums

- Significant vehicle repairs

- Veterinary costs for pets

- Escalating gas prices since 2021

- Emergency plumbing and electrical repairs

- The high expense of replacing broken appliances

- The steep costs associated with personal technology such as cell phones and laptops

- Temporary job loss, which can take months to recover from financially

- Student loans that must eventually be repaid

Finding funds to contribute to a 401K can be a challenge when expenses seem to multiply.

Section 1.2: The High Cost of Insurance

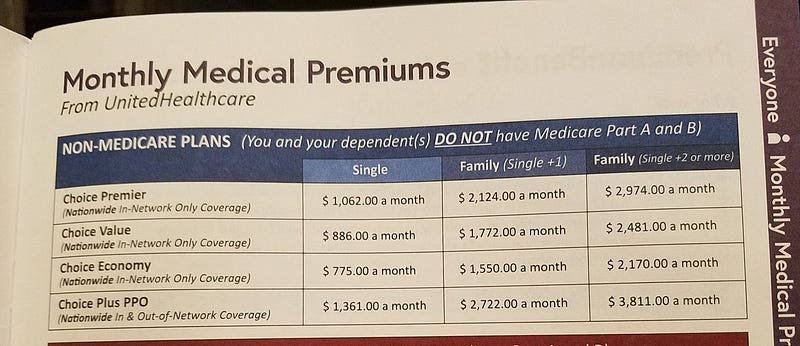

Currently, my husband and I can afford our healthcare coverage, especially now that our son is financially independent. Yet, when I recently renewed my health insurance plan, I was taken aback by the exorbitant monthly premiums for a working-class family plan:

The chart shows monthly premiums reaching as high as $3,811 for families with three or more members. This figure is indicative of a larger issue affecting many households and is just one of the elements that complicate effective budgeting.

Chapter 2: The Burden of Debt

According to a report from CNBC, as of 2022, the average U.S. household with debt owes approximately $155,622 across various types of loans and credit.

Why Budgeting (Almost) Always Fails (And How to Make It Work For You)

This video explores common pitfalls in budgeting strategies and offers actionable solutions to create a more effective financial plan.

Section 2.1: The Insufficiency of Emergency Funds

Many financial advisors suggest a starter emergency fund of $1,000. However, true emergencies often exceed this amount. When multiple emergencies occur back-to-back, which is a common scenario, people often resort to credit cards, accumulating high-interest debt. Ramsey does recommend saving three to five months’ worth of income for emergencies after establishing an initial fund, but achieving this goal may take several years for many families, during which unplanned expenses continue to arise.

Section 2.2: Identifying Budget Leaks

A few years ago, I discovered that dining out was a significant drain on our budget. It wasn’t just high-end restaurants; even casual dining spots were costing us hundreds each month. Additionally, we were surprised to find that our frequent trips to Home Depot were leading to unnecessary spending on non-essential items.

Chapter 3: Saving through Sacrifice

For many households, saving money often requires making sacrifices. Here are some practical financial tips gathered from individuals who have navigated these challenges without formal finance backgrounds:

- Avoid purchasing new vehicles, even those offered at 0% interest due to immediate depreciation.

- Live within your means, disregarding what loan officers claim you can afford.

- Invest in a home warranty to cover significant repair costs.

- Replace costly cable services with affordable streaming options to save annually.

- Conduct research before heading to the vet for your pet’s health issues.

- Opt for short trips instead of expensive vacations.

- Prepare homemade lunches and skip daily specialty coffee purchases.

- Evaluate the necessity of high-end hair and nail services.

- Stay clear of high-interest "easy money" checks from banks.

- Consider whether your children truly need expensive gadgets for self-worth.

In conclusion, reflect on the barriers you face when budgeting for your household. What strategies do you employ to stretch your finances in tough economic times?

The Brutal Truth About Budgeting: Why Most People Fail

This video discusses the harsh realities of budgeting and why many individuals struggle to stick to their financial plans.

Linda Miller Bird honed her skills in creating impactful content through a distinguished career as a public relations executive and a CEO speechwriter.