The AI Revolution: A Long-Term Investment Perspective

Written on

Chapter 1: Understanding the AI Landscape

The future business landscape necessitates a consideration of artificial intelligence (AI).

Despite the overwhelming hype surrounding AI, it represents a growth trajectory that spans 5 to 10 years, making it an ideal opportunity for those in their mid-20s navigating financial challenges—or really, anyone interested in the future.

Much like an exhilarating journey, AI offers a multifaceted future filled with vibrant, unexpected, and exciting opportunities. However, it’s essential to recognize that this evolution is gradual; it’s a long-term process rather than an immediate explosion of change.

Prepare yourself for this transformative journey. Below, I share the AI frontrunners I believe will thrive in the long term, despite the unpredictable nature of many projects that often fall short of their promises.

Section 1.1: Nvidia—The Leader in AI Innovation

“The tech industry is experiencing two concurrent shifts—accelerated computing and generative AI.” — Jensen Huang, CEO of NVIDIA.

As businesses increasingly invest in AI, the demand for specialized graphics cards capable of handling AI tasks will grow. Nvidia currently occupies this critical market space, leading to soaring stock prices that might seem excessive.

You might wonder, how does one assess the value of a stock? For instance, Nvidia reported earnings of $10 billion in 2022 while boasting a market capitalization of $1.06 trillion. This raises the question: is it reasonable to invest $1.06 trillion in a company generating only $10 billion?

To satisfy market expectations, Nvidia must not only perform well but significantly outperform its competitors. A single quarter of mediocre results could trigger a sharp decline in its stock price.

Nonetheless, I view Nvidia as one of the top long-term investment opportunities of our era. Tech analyst and I/O Fund CEO Beth Kindig echoes this sentiment, describing Nvidia as the "Apple of AI."

“Technological investments have historically focused on consumers, but will now shift towards enterprises, with Nvidia at the forefront.” — Beth Kindig.

Nvidia is poised for growth over the next decade, albeit with periodic fluctuations. I'm waiting for a price correction before making additional investments, echoing Warren Buffett's strategy: “Wait for the excitement to peak for six months, then make your move.”

Section 1.2: AMD—A Competitor in the AI Space

“It’s clear, especially with the rise of generative AI over the past year, that this industry holds immense growth potential. We anticipate a 50% compound annual growth rate over the next five-plus years, a rarity for markets of this magnitude.” — Lisa Su, CEO of AMD.

If Nvidia is the Apple of the AI world, then AMD can be likened to Android—slightly rough around the edges yet still very much in the game.

Nvidia's H100 graphics card is currently the most desired AI product, with production sold out until 2024. However, AMD's Instinct MI300 presents a formidable alternative in terms of performance. Moreover, AMD is unique in offering a comprehensive portfolio of both GPUs and CPUs, enabling it to bridge the AI gap.

Rumors suggest that major tech companies, including Meta, Microsoft Azure, and Amazon AWS, are lining up for MI300s. Azure, in particular, has become one of AMD’s primary clients, recently announcing plans to develop the largest supercomputer globally utilizing AMD technology.

While Nvidia holds a technological edge over AMD in several high-performance computing tasks, capturing even a modest share of Nvidia's market could yield substantial rewards for AMD.

Chapter 2: The Role of TSMC in AI Development

Consider this: If Taiwan is crucial to the semiconductor and microprocessor sectors, why hasn’t the U.S. established its own fabrication plants?

Investing billions into local fabs may be advantageous in the long run, so what’s stopping us?

The reality is that constructing a state-of-the-art semiconductor facility demands significant time, expertise, and capital. Moreover, semiconductor manufacturing is complex and often messy, reminiscent of the heavy industries that once thrived in the Rust Belt.

There are claims from Taiwanese semiconductor workers that Americans lack the work ethic to handle such facilities. Additionally, with the U.S. facing numerous environmental regulations, it's doubtful that heavy industry will return.

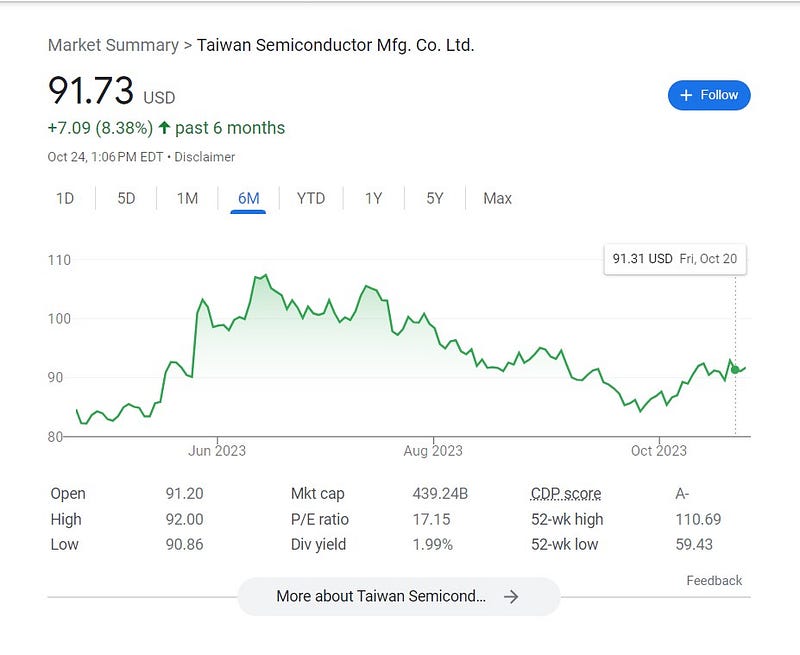

Despite these challenges, Taiwan Semiconductor Manufacturing Company (TSMC) is an attractive investment. They are the preferred partner for major tech players like Apple and Nvidia, and the geopolitical risks associated with potential conflicts with China are a persistent concern.

Section 2.1: The Future of AI and Its Economic Impact

Artificial intelligence is set to transform the global economy, boosting productivity and competitiveness at unprecedented rates. Ultimately, the market will determine its worth, just as it has throughout history.

While there are concerns regarding job losses due to automation, the reality is that if machines handle the more labor-intensive tasks, the costs of various services and products will decrease.

I won’t delve into an exhaustive economics lesson, but for context, look into the Luddites—people who have historically resisted technological advancements. Despite fears, society has consistently progressed and improved over time.

Of course, one could argue that technology may lead to a decline in the human spirit, a notion worth considering. However, I maintain an optimistic outlook. If we do find ourselves in a dystopian, Blade Runner-like world, I’m not entirely opposed to that scenario.

For unlimited access to all of Medium, consider signing up for a subscription through my referral link.

Join over 4,000 individuals on my Substack to receive a copy of my new eBook "Gold2.0."

Since childhood, I aspired to be a financial advisor, a dream that unfortunately didn’t materialize. Therefore, I'm not a financial advisor, and you should conduct your own research instead of relying solely on advice from online sources. Nothing in this publication should be interpreted as investment advice.